As any entrepreneur will tell you, creating a business takes courage and some blood, sweat and tears. In 1878, Thomas Edison founded a small business he named the Edison Electric Light Company to market his new incandescent light bulb. It soon grew to Edison General Electric before becoming the General Electric Company with funding from J.P. Morgan.

Just like a story cannot be written without first putting pen to paper, a small business cannot spring to life without funding. Unfortunately, people with great ideas don’t always have the money to get started. That is where Guidant Financial comes in.

Many funding options exist to entrepreneurs from 401(k) business financing, to SBA loans, unsecured loans, portfolio loans and more. A Rollover for Business Start-ups, for example, is for founders wanting to use their retirement funds in a retirement plan to purchase stock in their business.

With the abundance of options available, access to funding, it seems, isn’t the only daunting aspect. Determining which loan is right for each customer and business concept and situation is perhaps more intimidating. Guidant, however, makes the entire process easy for prospective business owners.

The industry leader, Guidant’s innovative products and solutions have helped launch over 25,000 small businesses. They structure more Rollovers for Business Start-ups arrangements each year than any other provider and boast a spotless IRS track record. And, as they like to say, “small business financing doesn’t have to be complicated.”

To serve their customers best, Guidant wanted to better understand the customer journey and the problems they experience along the way. Guidant’s goal was not to reduce inbound calls but to relentlessly improve customer experience. First, they needed to comprehend the operational issues customers were facing.

They initially gathered information in a shared spreadsheet and by logging customer pain points in Salesforce. With their customer volume, it took significant time and human capital to review and sort through the information shared. Plus, it was laborious for Guidant to tease out the pertinent feedback details so they could understand the root causes and possible solutions.

It was likewise difficult to quantify the data. And, while talented team members used their functional expertise to learn from the information gleaned, the lessons were often not broadly understood. They were simply too difficult to share without multiple meetings and more time lost.

Enter Emma Brumley, scrum master on Guidant’s engineering team, who has worked across customer experience, fulfillment, and engineering teams during her ten years with the company. With her broad perspective, Emma understood that to deliver outstanding customer experience, Guidant needed quantitative data.

While completing unconnected surveys or spreadsheets were the traditional means to capture ad-hoc data, she knew they were burdensome to already busy employees. Plus, the information was not captured in-the-moment, so key points were easily forgotten and not always accurate.

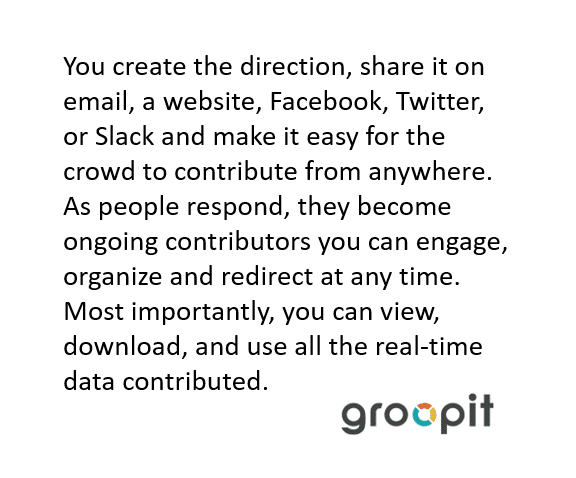

To tackle this challenge, Emma implemented Groopit to track customer feedback within Salesforce. With a few quick taps from their existing workflows, employees easily captured customer feedback such as the issue or reason for the call as well as the customer sentiment related to every piece of feedback. According to Emma, “Groopit is the fastest way to get real-time product feedback and data for insights that are hard to quantify.”

This information quickly helped Guidant understand the primary reasons customers call. The data and insights were then immediately delivered to the product and operational teams making decisions about what to prioritize. Within the first week, Emma and her team were able to quickly pivot their focus as needed to prioritize new technology, content and training that quickly addressed and prevented customer experience problems.

And, Guidant’s employees achieved 90% adoption and ongoing engagement because Groopit is so fast and easy to use. Emma remarked that, “Groopit delivers actionable insights needed to improve customer experience, without burdening front-line employees.”

Using Groopit, Guidant reduced the time required from hours to seconds to spot trends. Instead of manually categorizing and aggregating data, Guidant immediately had the needed data as it evolved. Plus, Groopit helped Guidant infuse the customer’s voice into every decision, whether a new feature, content, training, or whatever was needed to improve their experience.

“Having high quality customer insights is game-changing,” said Jeremy Ames, Guidant Financial President and Co-founder. “Groopit gives our leadership team the agility we need to inform any decision with insights from what our team is hearing from customers.”

Emma’s customer-experience initiative was so successful that Guidant has expanded Groopit to include their compliance team. Using 401(k) business financing is extremely complicated because of the rules and regulations required by the Department of Labor. Guidant wanted to understand and address the sources of mistakes on Form 5500 reporting.

With Groopit, Guidant is able to identify specific training and knowledge gaps, solve problems, and reduce error rates. What previously took the compliance team manager a long time to identify was now almost instantaneous. According to Emma, “Groopit made a huge difference in how we approach training and reporting.”

Today, Guidant is improving customer experience every day. At Groopit, we’re thrilled to deliver those game-changing employee insights because we agree that small business financing doesn’t have to be complicated.

Fostering someone’s dream is important work. We’re happy to help.

Learn more about Groopit >>